Credit check: key insights into improving hiring decisions

A crucial element of pre-employment background screening is the credit check. This practice is now a standard procedure across various industries, especially in banking, insurance, and sectors that manage sensitive data or significant assets, such as energy and technology. In these fields, credit checks are a routine part of the recruitment process to ensure candidates are thoroughly vetted.

A credit check offers valuable insights into a candidate’s financial health and helps the company evaluate potential risks associated with an open position. Why is this so crucial for companies?

The ACFE estimates that organizations lose an average of 5% of their annual revenue to employee fraud. Therefore, conducting credit checks is a critical measure for mitigating financial and operational risks within the company.

What is a credit check?

Credit check is a process used to evaluate an individual’s financial health by examining their credit report. This involves reviewing their credit history, which includes details about debts, payment patterns, and other credit-related information.

In Indonesia, a credit check includes an assessment of various types of loan services, such as online loans, mortgages, motor vehicles, and other financial loans regulated by the Financial Services Authority (OJK). All transactions related to these loans are meticulously recorded in the Financial Information Services System (SLIK) maintained by the OJK.

Whereas in Malaysia, a credit check assesses detailed financial information, including trade or credit references from non-bank sources, credit scores, and payment patterns from banks. This extensive information is available through credit reporting agencies.

Why is credit check important in the hiring process?

Credit checks are typically recommended for roles with substantial financial responsibilities or positions that involve handling sensitive data and company assets.

-

Preventing potential fraud

Identifying candidates who are experiencing serious financial difficulties is essential for minimizing the risk of fraud or abuse in the workplace. The “Report to The Nations” 2024 study highlights that living beyond one’s means and ongoing financial struggles are significant warning signs that companies should watch for to reduce fraud risk.

Understanding a candidate’s financial situation helps companies prevent potential conflicts of interest stemming from personal financial problems. Employees with significant debt or financial issues may feel pressured to seek extra income, which in severe cases could lead to unethical behavior, such as accepting bribes or giving preferential treatment to certain vendors for personal gain.

-

Assessing employee reliability and integrity

Credit checks offer valuable insights into how candidates handle their financial obligations. This history reveals their ability to manage finances responsibly, which can reflect their overall attitude toward responsibility and integrity in the workplace.

-

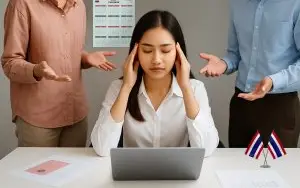

Maintaining productivity

Hiring employees with low credit scores should be a major consideration. Financial difficulties can impact concentration, task management, and increase stress levels, all of which can affect performance and productivity.

-

Regulatory compliance

In some industries, such as finance and banking, companies are required to conduct credit checks on prospective employees, especially for positions involving access to funds or sensitive information.

Benefits for the company

Enhancing hiring quality

A credit check provides additional information that helps companies make better and more strategic hiring decisions. With this information, companies can refine their selection process, better match candidates to positions, and reduce the risk of hiring mistakes. This approach helps lower employee turnover and prevents negative impacts on overall company performance.

Increasing security and trust

Companies that perform credit checks demonstrate their commitment to maintaining a secure work environment, upholding integrity, and ensuring regulatory compliance. This practice builds trust with employees, clients, business partners, and investors, showing that the company adheres to high standards in recruitment and risk management.

For more information on credit checks and other types of checks, contact us today!